MOScholars Program

Click here to access the State Treasurer’s Office information about the program.

Families: If you have students you believe will qualify, please find the link to the pre-qualification form below.

*The Herzog Foundation is accepting applications for the 2024-2025 school year. Click here for prequalification:

Click Here To Start Your MO Scholars Prequalification

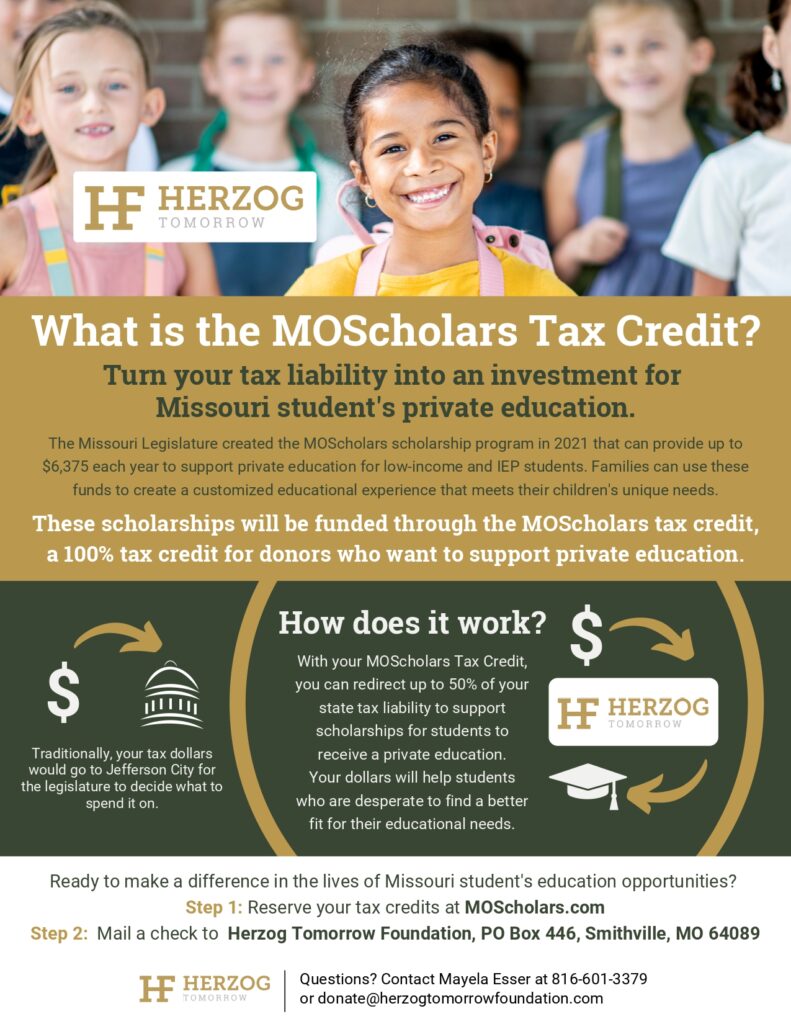

Donors: Herzog Tomorrow Foundation is working with the state of Missouri to issue over 700 scholarships to low-income students and students with IEPs to attend private Christian schools like Christian Fellowship. Thousands of dollars have been awarded, and there are still more CFS students waiting for more funds to become available. These scholarships are funded by a new Missouri tax credit program that started on July 1, 2022. The MOScholars tax-credit program allows individuals and businesses to redirect up to 50% of their Missouri tax liability with a 100% tax credit for donations to the Herzog Tomorrow Foundation.

Here’s how you can reserve your tax credit:

1. www.moscholars.com

2. Once on the MOScholars page, on the right-hand side of the page click on “Tax Credit Reservation System”

3. Select “Herzog Tomorrow Foundation” as your EAO (Educational Assistant Organization) to receive your tax credit

4. Mayela Esser, follow up with you after they receive your tax credit reservation.

Mayela Esser, at the Herzog Tomorrow Foundation would be happy to connect with you over a call to answer any questions you might have. You can reach her at 816-601-3379 or email her directly at messer@herzogtomorrowfoundation.com

How does it work?

Missouri’s only 100% tax credit program is available to any business owners or individuals with personal tax liability to the State of Missouri. What is unique about this program is that it is not funded directly by the state of Missouri. Instead, the six Education Assistance Organizations (EAOs) approved to grant MOScholars scholarships to students are also responsible for raising the scholarship money. To help them do that and to make supporting the fund painless for donors, the program includes Missouri’s only 100% tax credit as an incentive to donate. The MOScholars tax credit is not a traditional deduction on your taxes; instead, it is a dollar-for-dollar credit that reduces your state tax liability in an amount equal to the donation you make to the scholarship fund. You can donate an amount that is up to 50% of your state tax liability.

Most people do not usually use state tax credits, but this new MOScholars tax credit is available to anyone who can donate $500 or more. As long as you owe $1,000 to the state, you can support MOScholars. For example, if your state tax liability will be $2,000, you can donate up to $1,000 and you will get a $1,000 tax credit certificate that you later use when filing your state taxes to reduce your tax liability by that same amount. The 100% tax credit allows YOU to essentially decide where your tax dollars go.

ACE Program

Financial criteria for the ACE Scholarship Missouri program has gone up substantially this year. More info and application link can be found here:

https://online.factsmgt.com/grant-aid/inst/4NG9J/landing-page

More information about the ACE Scholarships:

The ACE Scholarship was created to provide low-income parents with the freedom to choose the K-12 schools that are best for their children. The ACE application is set to open on February 5th and close on April 15th. Families are served on a first come first serve basis and funds are limited so early application is essential. Current tax returns are a requirement for application. For complete information regarding the ACE Scholarship, qualifications, application process and FAQs, please use this link to their website: https://www.acescholarships.org/